Today’s Mortgage Rates & Trends, April 27, 2022

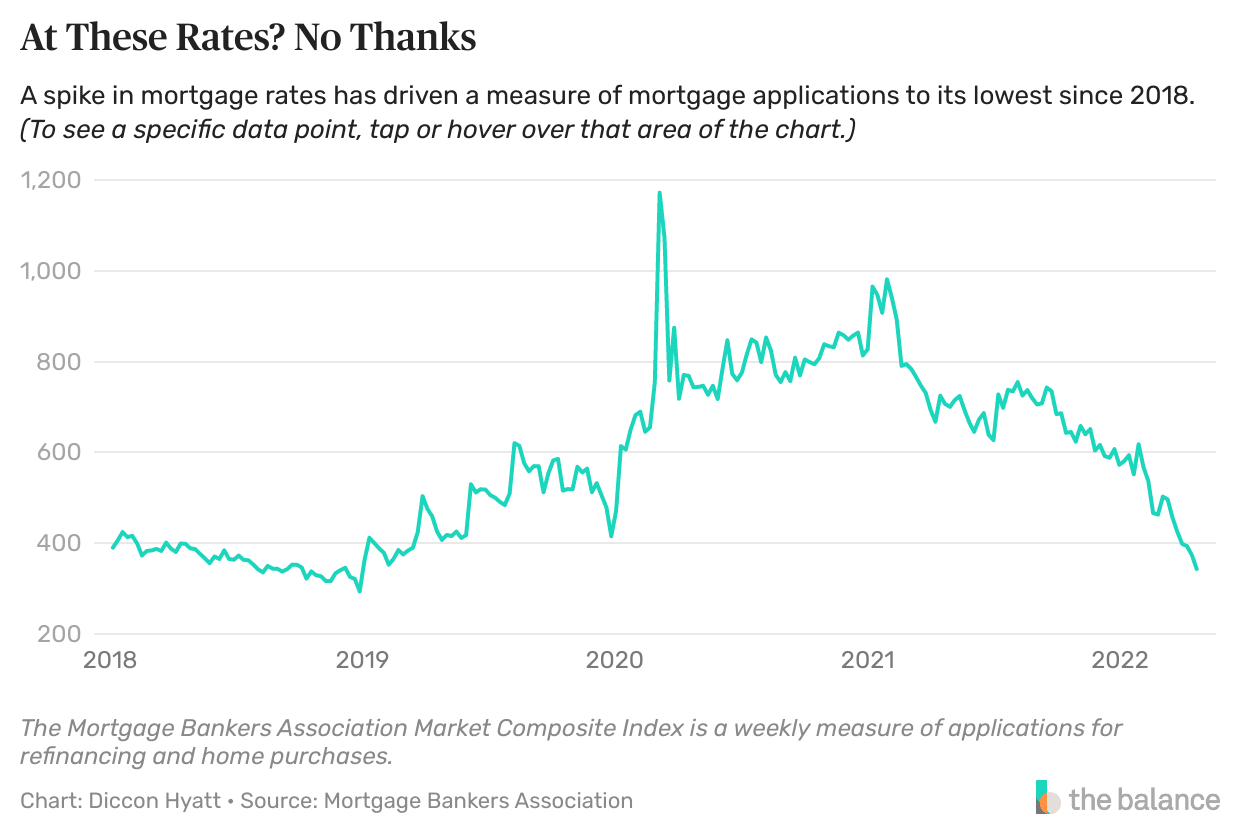

Mortgage rates fell for a second day, reaching their lowest levels in at least a week. The average on a conventional 30-year fixed mortgage fell to 5.69% from 5.75% the previous business day. Earlier this month it vaulted to 6.19%, its highest point since at least 2019, and likely much further back. (Our daily mortgage … Read more